This person is reading about the ideal way to combine your finances.

This person is reading about the ideal way to combine your finances.

There’s no question that finances are a constant source of tension and stress for most couples. In fact, it’s often cited as a leading cause for divorce.

The surprising part is that it’s not a lack of money that causes the tension, but rather a lack of compatibility around how the money is managed.

To preempt those issues, my wife and I spent time discussing how we wanted to combine our finances long before we were married. What follows is the system we landed on, and why.

To start, there are three things that any system should be able to handle:

- Different spending types (e.g. loose spender vs. penny pincher)

- Different incomes (e.g. a couple with a proverbial “breadwinner”)

- Equal ownership over money (i.e. level footing between partners)

As a bonus, it’d be great if the system is robust enough to adapt to changes in these areas over time and to handle periods of financial hardship.

Before we get to the system we chose, let’s quickly review four other approaches that people commonly take and see how they stack up against those goals.

1. The “I’ve got it” approach

The “I’ve got it” approach is when expenses are split on an ad hoc basis. Someone agrees to pay the water bill while the other person picks up the cable bill, and you might rotate who pays for dinner or groceries. On the scale of how combined your finances are, this ranks at the very low end for married couples.

Not unexpectedly, it doesn’t work well with different incomes and doesn’t provide both people with equal footing.

As an example, if one partner loses their income or stops working to take care of a family member, they become completely dependent on their partner to pick up all of the expenses. Even granting one person a “salary” to spend each month can belittle that person’s contribution to the relationship and remove their feeling of independence or equality. Moreover, the flow of money is subject to the whims of the high-earner and may eventually come with strings attached or be laced with guilt.

If you are just starting out with your partner and want to use this system, it might make sense to sign a cohabitation agreement.

2. The “let’s split it” approach

The “let’s split it” approach is when a couple chooses to contribute equal amounts — usually to a joint account — to cover shared expenses.

Splitting the cost of shared expenses equally is certainly a step in the right direction, but still fails the goal of handling income disparities.

More specifically, the couple is limited to spending within the means of the lower earner. That doesn’t scale when incomes diverge greatly (e.g. if one partner works in a historically low-paying industry such as teaching) and one person wants a higher standard of living. It fails entirely if one person loses a job or becomes a caretaker. In all cases, it leaves the low earner with less money left over for their personal expenses.

3. The “let’s split it, proportionally” approach

A twist on the “let’s split it” approach is to contribute in amounts proportional to each person’s share of the income. The higher earning partner will contribute proportionally more than the lower earning partner. If one person makes $80k/year and the other makes $40k/year, the former will pay for 2/3 of the expenses since they earn 2/3 of the total income.

While this is an improvement, it still gives unequal access to money. Even though the lower earner pays less of the joint expenses, they’ll still have less money left over for their own spending since they had a smaller “pie” to begin with. As an extreme example, if they make no money, they won’t pay for any of the shared expenses; however, they will also have no money available for personal spending. On the hand, their partner will still get whatever money is left over after paying for all of the shared expenses.

4. The “what’s mine is yours” approach

The final approach is to throw all of your money into a shared account and split everything, no matter what type of expense it is.

This is a great system if — and only if — you have similar spending types. If both of you are savers, great! If both of you are spenders, also great (from a compatibility perspective, at least)! But if one of you likes to spend more than the other, or spends money on things the other person doesn’t share an appreciation for — shoes, trips to Vegas, fancy watches — the guilt trips will only grow with time. It can also be hard to surprise your partner with gifts or experiences when everything is shared.

More importantly, even if you and your partner have compatible spending types right now, those can shift over time! You might become more conservative when you start a family, or you might become more of a spender as your income rises. Just because this system works now does not mean it’s the best possible approach to sharing your finances.

And that brings us to the system my wife and I settled on.

The “shared finances, with fun money” approach

The approach we landed on, and the one I’d personally recommend, is very similar to the “what’s mine is yours” approach detailed above with one small twist: each person gets a monthly allocation, or “fun money salary,” for their own personal pleasure.

The way this system works is simple: all money, including all paychecks and any other sources of income, flows into a joint account. All day-to-day expenses, including bills, living expenses, and other routine purchases, are paid for out of that joint account or on joint credit cards. You both have equal rights and ready access to your combined income and assets.

In addition to that, each partner gets an equal monthly allocation to spend on whatever they choose. Consider this your guilt-free money. You can agree on your own set of customs for how you use the money, but my wife and I have agreed that the only expenses we spend our fun money on are:

- splurges that don’t benefit the other person,

- gifts for the other person, or

- purchases that might elicit guilt trips from the other person.

The allocations can easily be adjusted to account for how similar your spending styles are: if you and your partner have similar approaches to money or lead strongly overlapping lives, the fun money salary can be very low; if you and your partner have dissimilar approaches to money or lead independent lives, you can give yourselves a larger fun money salary.

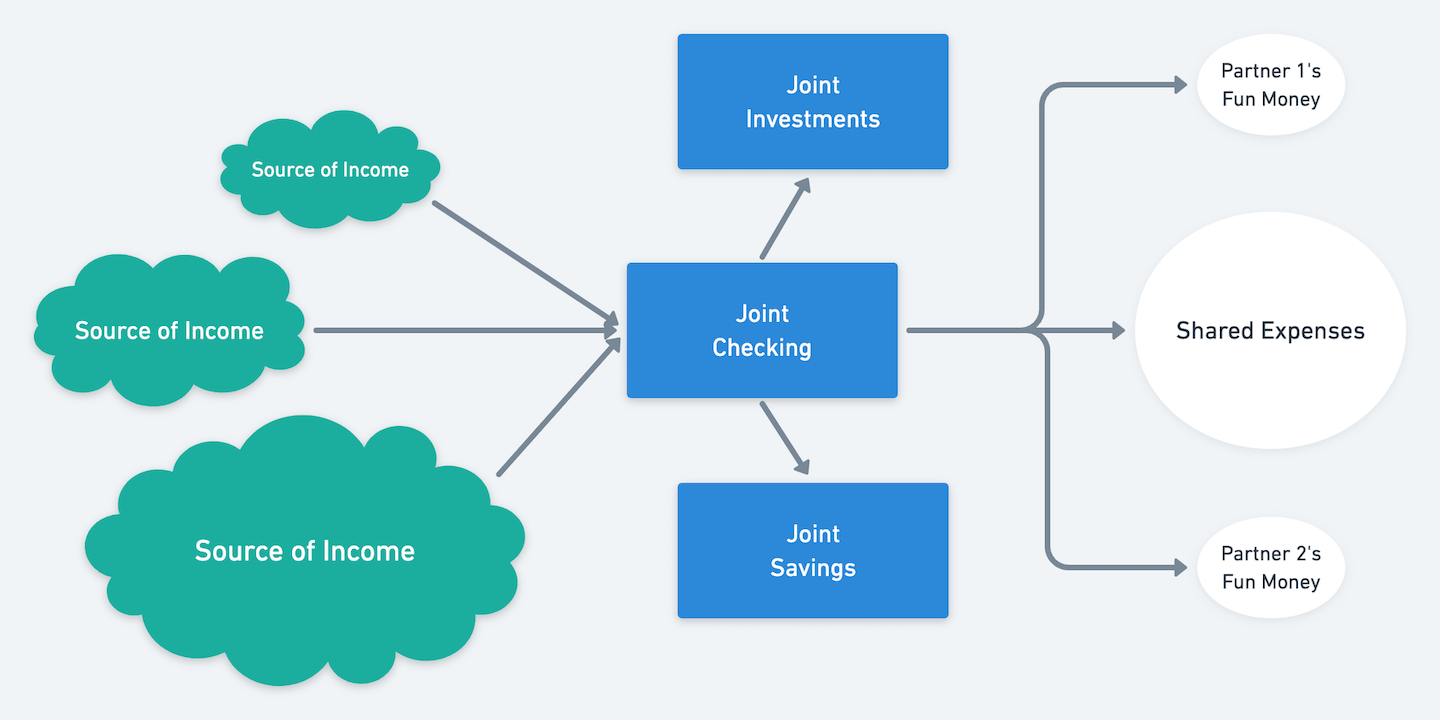

Here’s what the flow of money looks like in practice:

A diagram of the flow of money in the “shared finances, with fun money” system.

A diagram of the flow of money in the “shared finances, with fun money” system.

Having outlined the system, let’s test it against our three criteria:

Different spending types? Check ✔️

That’s what the fun money is for! To be clear: both partners still need to align on how much to allocate to fun money — a conversation that gets harder the more dissimilar the spending behaviors. However, having a deliberate conversation about that will be far less painful than letting micro-frustrations related to spending build up over time. And besides, the more frugal partner can always choose to save or invest any excess fun money!

Different incomes? Check ✔️️

All income is merged at the very beginning, so it doesn’t matter where it comes from. Both partners have equal access to it, and both partners will continue to receive the same monthly allocation for fun money no matter how much each person makes.

Equal ownership over money? Check ✔️

Because all of the money is merged at the paycheck-cashing stage, there’s no room for partisan ownership or hoarding. Both partners are on the same team and this system reflects that.

As an added bonus, the system can be adapted in the face of financial hardship by reducing the fun money allocations and enabling shared responsibility for reducing shared costs.

While every relationship is unique, this system is flexible enough to work well in most situations. At the very least, it’s working well for my wife and me!

And please — if you have not yet had serious discussions with your partner about how to manage your finances — now’s the time!